There’s no one way to market your business.

In Fintech, or in any other industry.

So if you’re looking for a step-by-step guide to acing the global Fintech market, this article isn’t for you.

But, if you are searching for actionable steps at every stage of the sales funnel, keep on reading.

Because once you understand the purpose and mechanisms of each level, creating your own funnel becomes easier.

And once you apply the overall principles of Fintech marketing to your unique digital marketing strategy, you’ll start to get somewhere with customers.

This article will show you how to move a prospect down each stage of the sales funnel and achieve more measurable rates of conversion.

Perfect for when you need to buck up your marketing ideas or explain the return of investment to your big boss!

Effortlessly export your Google Docs to WordPress with just 1-click.

Get Started TodayThe top of the funnel serves to inform and educate potential customers who don’t yet know you exist.

There are several ways to get visible in front of your ideal client, including:

Each of these forms of digital marketing enable the fintech company to increase brand awareness.

This is a key step for later interaction with the target market and eventual conversions into sales.

Did you know that 90% of all indexed pages on Google get absolutely no traffic?

That’s right: zero views, zero clicks, zero leads.

So how can you make sure that your fintech company is part of the elite 10% to garner website business?

It starts with a simple search engine optimization strategy.

“But the algorithm is forever changing?”

While SEO does vary due to updates, the core principles have remained unchanged since the practice began. So you don’t have to be an expert.

Search engine optimization has three major channels:

SEO tools and tactics

Technical SEO focuses on backend factors such as IP canonicalization and crawlability. It’s usually taken care of by the programmers and web developers.

Where you can make an active difference, is on the link-building and content marketing sides of optimization.

Building links will increase your authority and trust in the fintech industry, and site legitimacy.

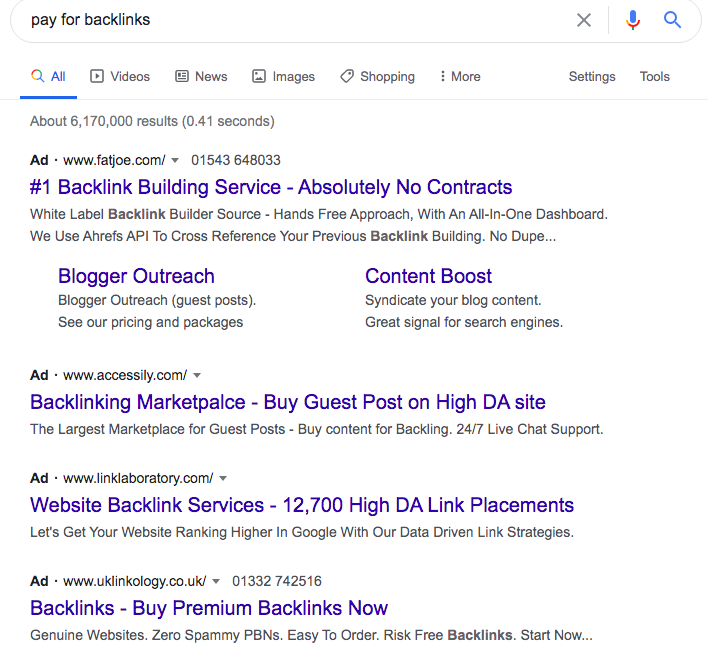

It used to be the case that the more links you could build, the better. It was common practice to pay for a service which built a link to your site from theirs. All you have to do is a quick google search to find there are still plenty of backlink buying services.

However, these sites are spammy, and Google will actually penalize anyone found to use this method.

Instead, build high quality links by:

Keyword targeting is often seen as the ‘holy grail’ of SEO, but keyword stuffing can result in over-optimization, which will have a negative impact on your rankings.

For example, using anchor text (internally linking to another URL) that uses keywords can have a negative impact.

Instead, good fintech marketers will target low volume but highly relevant keywords.

We often overlook social media as the place to advertise within Fintech, but getting it right can bring roaring success.

Starling Bank installed the Facebook SDK feature to its challenger app to track user behavior.

The company also had access to software which made sure they didn’t target current customers, diverting spend towards more effective leads.

The Fintech startup could target custom audiences based on demographics that weren’t previously available.

The social media tool also helped them find lookalike markets who might also be interested in their product.

Starling decreased their cost-per-conversion by 36% in just a one month period.

Explore other social media networks and management tools depending on your ideal customer, including:

As Starling has shown, advertising on social media brings a human appeal to your brand.

Emulate this in your own business to break the usual tech and jargon barriers that are associated with Fintech.

The more casual nature of these platforms means that it’s easier to create a relationship.

Social media builds trust with potential customers, which every Fintech company can be using to their advantage.

Ads can be an effective strategy because they guarantee visibility within the exact audience you specify- in this case, the fintech market.

Plus, pay per click campaigns offer a clear cut return on investment (ROI).

In fact, for every $1 spent on AdWords in 2019, businesses earned an average revenue of $2.

The key to ads in the Fintech Industry?

A Data Driven Approach

The recent trends in fintech startup culture has meant that there is now plenty of available data about audience behavior and buying patterns.

Constant testing will allow fintech digital marketers to confidently apply their ads strategy without wasting time or money generating untargeted or unqualified leads.

Applying a/b testing to emails will test the effectiveness of different copy or angles on the same audience.

This should enable Fintech marketers to narrow their niche and double down on successful strategies.

The middle of the funnel serves to generate leads.

Once a prospect has moved past the brand awareness phase, your financial institution should interact and generate interest.

The middle-of-the-funnel will also enable you to begin qualifying the strongest leads, and ruling out those who aren’t a good fit.

Lead magnets are a really popular marketing method, especially for a small, new fintech firm to get into the inboxes of its potential customers.

Fintech lead magnets act as ‘freebies’ given away in exchange for your email address.

They usually trigger a series of automated welcome emails once the prospect has received their bribe.

This is email gated-content, and could be a downloadable guide, worksheet or even a free trial period for a custom fintech software development.

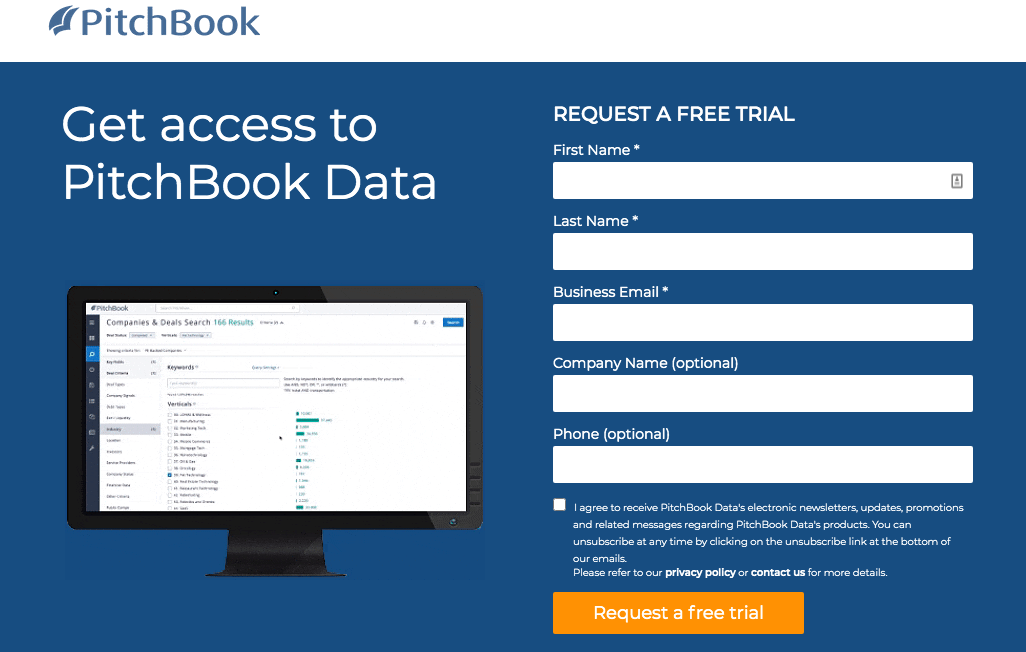

A free trial is exactly what fintech company Pitchbook, who focus on data mining, offer in exchange for business email and information.

The lead magnet owns its own landing page, which first time site visitors are automatically redirected to.

This makes sure that the Fintech company doesn’t bother its previous purchasers.

The lead magnet is effective as it allows the software to speak for itself, providing value over a 30-day period.

It also means that the startup can keep email addresses of those who cancel to convert at a later date.

At Wordable, we also offer a free trial to allow users a testing phase before they commit.

We grant three free exports of Google Docs into fully formatted WordPress posts.

It’s a win-win, since clients love a freebie and it allows us to reach new customers.

You’ve likely heard the words “face-to-face networking is dead”.

And it very much is in some areas.

But Fintech is slightly different.

Yes, it’s driving forward the newest innovations with breakthrough technology.

But Fintech also encompasses financial services providers who prefer the ‘old-school’ methods.

You know, the guys who still wear suits to work.

So in actual fact, there’s still value in face-to-face fintech networking events that lack in other industries.

And these sorts of chatty seminars can be intimidating.

You can’t hide behind a screen for one.

Plus, being put on the spot to pitch and convert a client real-time can result in painstakingly long minutes of fluff.

But, the benefit of in-person networking is clear.

Because companies generate around $12.50 for every dollar invested in face to face meetings.

So what exactly are the magic words?

The Elevator Pitch

Imagine you’re sharing an elevator ride with your ideal client inside a 10-story building.

Cut the lift music, the prospect asks you about your company and what you do.

How would you respond?

The elevator pitch uses a distinct formula:

“I help X with Y using Z”

X is the ideal client that your product targets. Y is the problem your product solves. And Z is the way your product works to solve it.

Let’s take Xero, the accounting software fintech business as an example.

Their elevator pitch might be:

“Xero helps SMEs with accounting using intuitive software to automate payments and invoices”.

Apply this formula to your own Fintech brand the next time you’re lost for words, it seriously can’t fail!

The initial idea with marketing is to cast a wide net to attract a large pool of prospects.

But this pool becomes thinner and thinner as they continue through the process.

So, the bottom of the fintech sales funnel serves to filter out unqualified leads and convert customers who do fit your ideal market.

It’s a double-pronged fork, encompassing email marketing and lead qualification.

You’ve already set up your lead page to effortlessly capture email addresses.

That email creates a short cut, because 99% of email users check their inbox every single day. Allowing you to straight into the eyesight of your customer.

Email marketing can indicate the quality of a lead by two metrics:

The general rule is that a customer will be exposed to marketing messaging seven times before deciding to buy the product.

So, sending multiple emails over a period is more likely to result in conversion.

Here are some other ways you can increase those all-important open and click-through rates.

Personalized Subject Lines

Simply put, a personalized subject line can increase email open rates by 22%.

Open rates are the gateway to click-through rates, since you have to open an email first.

In Financial Services, it can be hard to personalize the subject lines of emails, especially when the body of the email is filled with jargon.

But, here are some ways to personalize the subject line:

Tagging

Using an automated email provider allows you to track user behavior.

Use this data later for more targeted communications.

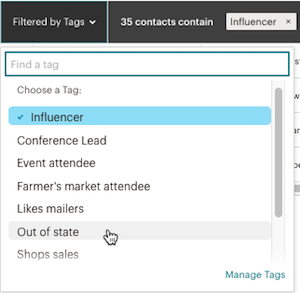

The image below shows possible tag categories on Mailchimp’s software.

It highlights how you can group together prospects from where you gained their email address, or their interactions with your emails.

You control the settings and might manually tag prospects, or integrate your email software with other tech to tag automatically.

For example, you might apply the “Likes Mailers” tag once a prospect hits a 75% open rate on at least 5 of your emails.

Behavior tracking means you can further hone in on your prospects needs, invoke their emotions and pitch at the right time.

Fintech company Stripe attributed tagging their email list to help grow overall customer numbers by 10x between 2018 and 2020.

The overall goal of digital marketing is to generate leads for your fintech business.

But those leads are pointless if they are not fit to buy from you.

And so each of the steps of the funnel will help filter out the ill-fitting prospects and help confirm those who do require your products or services. Once confirmed, the last step of the customer’s journey is the process of customer onboarding.

The original Fintech lead qualification framework, known as “BANT” was devised by IBM.

The method aims to focus on aligning the customer Budget, buying Authority, Needs, and Time constraints with its product.

Adopting this in the fintech niche means scoring your leads and prioritizing the most highly ranked.

For example, determine buying authority by looking at the titles of previous customers. If only managers tend to purchase, it might not be worth targeting assistants who don’t have the jurisdiction to make the call.

It’s how you’ll determine your ‘hot list’ for even more targeted communications, and is one of the best methods to guarantee ROI.

There are quite a few different ways to draw in clients in the Fintech industry, and luckily, you can try out the best strategies for your unique business situation.

Whether you’re an already established and known financial brand, or a newer start up without much brand awareness- everyone has something to improve on.

So start by targeting one specific strategy and implement it into your digital marketing process.

And if you can improve by just 1% every day, the overall margin behind your sales and conversions will skyrocket!