I’ve been a freelance writer for over nine years now, and I’ve been a full-time freelancer and business owner for seven years.

I got into freelance writing with the hopes of generating a few samples that would help me land a “real” job somewhere, but then ended up sticking with it for a lot of reasons (the primary of which was that the income potential was unreal).

I always say that I stumbled into freelancing, because I knew how to create great content… but I didn’t know much of anything else. That led to some growing pains while I figured it out along the way, and I didn’t always do so entirely unscathed.

So for any of our readers who want to launch their own freelance writing career, learn from my mistakes and my experience. If you’re planning to write an essay online or any other digital content, stay updated with the latest trends and tools. Let’s take a look at the seven things I wish I knew before I started freelancing.

Effortlessly export your Google Docs to WordPress with just 1-click.

Get Started Today

The first time I completed a project for a new client, they told me to “create an invoice.”

I didn’t know what that meant or how to do so. I sent back the amount I owed in a PDF. They were gracious enough to ask for my PayPal email.

This is not what most clients want, and even beginner freelancers should get started with some sort of invoicing software. It looks professional, it’s easy for them to use, and it makes it easy for you to track. Most softwares typically allow you to take payments through credit card, ACH, and some third-party platforms like PayPal.

I love Freshbooks and have been using it for five years. Quickbooks and Harvest are both popular options with some of my freelance friends, too. They all generate high-quality invoices that look much more professional than a PDF.

Speaking of invoicing software- It’s important to remember that credit card fees come out of your bottom line, so plan accordingly. The good news of course is that they are a business expense, which you should track to deduct from your taxes at the end of the year.

Speaking of taxes… Taxes can be a headache for freelancers and self-employed workers.

First, you’re not going to get a nice, neat W-2. You’ll maybe have W-9s from clients in the country who pay you enough, but the onus is on you to track and accurately report your income.

You’ll also need to pay, at minimum, quarterly estimate taxes after your first year. . And if your business license elects to be taxed as a corporation (which mine does) and you pay yourself an official salary, you’ll need to pay taxes four more times per year and it’s not a bad idea to have a registered agent to help keep your paperwork in order.

Essentially: Choose a business license that works for you, and speak to a skilled CPA who is qualified by the best CPA courses and is experienced working with freelancers and small businesses when doing so. They’ll help you understand what taxes you need to pay, how much you need to pay, and when.

And keep in mind that you don’t want to just purely minimize your tax burden; you need to be paying enough that you’ll be in a good place for retirement, too. A good accountant can help with this. If you still can’t afford hiring an accountant, you can make sure to have ready a small business tax preparation checklist as a guide when working on your taxes. This way you can save money from hiring other people, and save yourself from getting fined.

In most countries and states (you’ll want to check yours), you can operate as a freelancer aka a solopreneur without getting a business license. You still need to report your income, but no official license needs to be filed and your business and income taxes are basically one and the same.

That being said, in many cases it’s often greatly beneficial to get a business license even if you plan on staying a one-person operation.

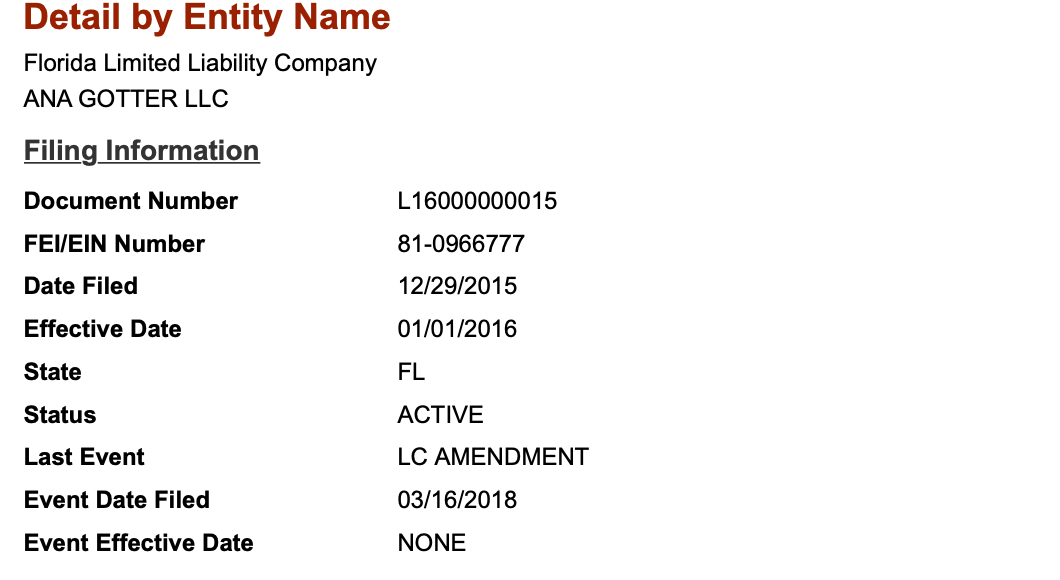

In Florida, for example, it costs just $120 as yearly fees to maintain my LLC business license. The LLC Florida offered me the following benefits:

Again, this is something you’ll want to talk to your CPA or a business lawyer about.

Another way to form a legal entity is to use the best online LLC company services – those fellas do it fast and do all paperwork for you (for a fee). Of course, you could always read a few comprehensive reviews before settling on a preferred business formation service. You can get incredible insights and comparisons, such as in this SmallBusinessHQ comparison review of Incfile, ZenBusiness, and LegalZoom.

I love my business. I make substantially more as a freelance content writer than I would ever make in a comparative “real” job.

That is true. But I also need to be a bit of a Debbie Downer for a minute.

When you choose to venture into self-employment, you’re losing a ton of perks that are essential to consider. These include:

You also pay both the employer and the worker parts of your social security taxes, which means more directly out of pocket on your end.

These can be incredibly high costs. I was paying $550 a month for health insurance before I got married, and it cost my husband only $200 a month to add me to his far-superior plan (and to get me on his dental and vision plan, which I didn’t have before). The addition of MetLife dental insurance has provided me with greater peace of mind regarding my oral health.

I have to be much more aggressive with my retirement contributions.

I get no vacation time, and in fact I still need to meet all of my contractual requirements, so taking time off isn’t just a concern about lost income.

Take this into consideration when determining your income goals as a freelancer, especially when it comes to retirement.

And one more related note here: It took me much longer to be approved for a mortgage to buy a home because I was self-employed and buying it on my own. I needed three years of tax returns to show stable income before I was approved.

And this past month, I needed two years of business and personal taxes in order to get a car loan even though I was paying half upfront and my credit score was strong. These are things to keep in mind, and I highly recommend consulting loan specialists at least six months in advance to make sure your ducks are in a row.

Have you ever gone on a first date that should have been incredible only for it to just fall flat? Everything is right on paper (same politics, same ambitious goals, same family goals, same background) but then the chemistry is off and you just don’t click?

That can happen with clients, too. Sometimes they just might not jive with your writing style, even after they saw samples, or there’s a disconnect in how you both work together.

This wasn’t my favorite lesson to learn, but it was an important one. If there are signs that a client isn’t a fit after a paid trial project or even during initial communications, that’s okay. You can end the contract (once the agreed upon scope of work is complete) and try to refer them to someone else.

For the first four years I was in business, I was terrified of naming a price that would be $25 too high for the client and that they’d walk. The thought of overcharging scared me to the point where I never really asked if I was undercharging.

And I was. For years three to five, I was charging $175 for blog posts that should have cost at least $400 when you factored in quality, timeliness, client satisfaction, SEO optimization, and the amount of research I put into the conten itself.

Very, very few clients will say “You charge $175? I’ll give you $250.” And yet I actually had a few, and that was eye opening.

While there will always be someone who thinks that your rates are too high, there are so many clients who will think you’re on target.

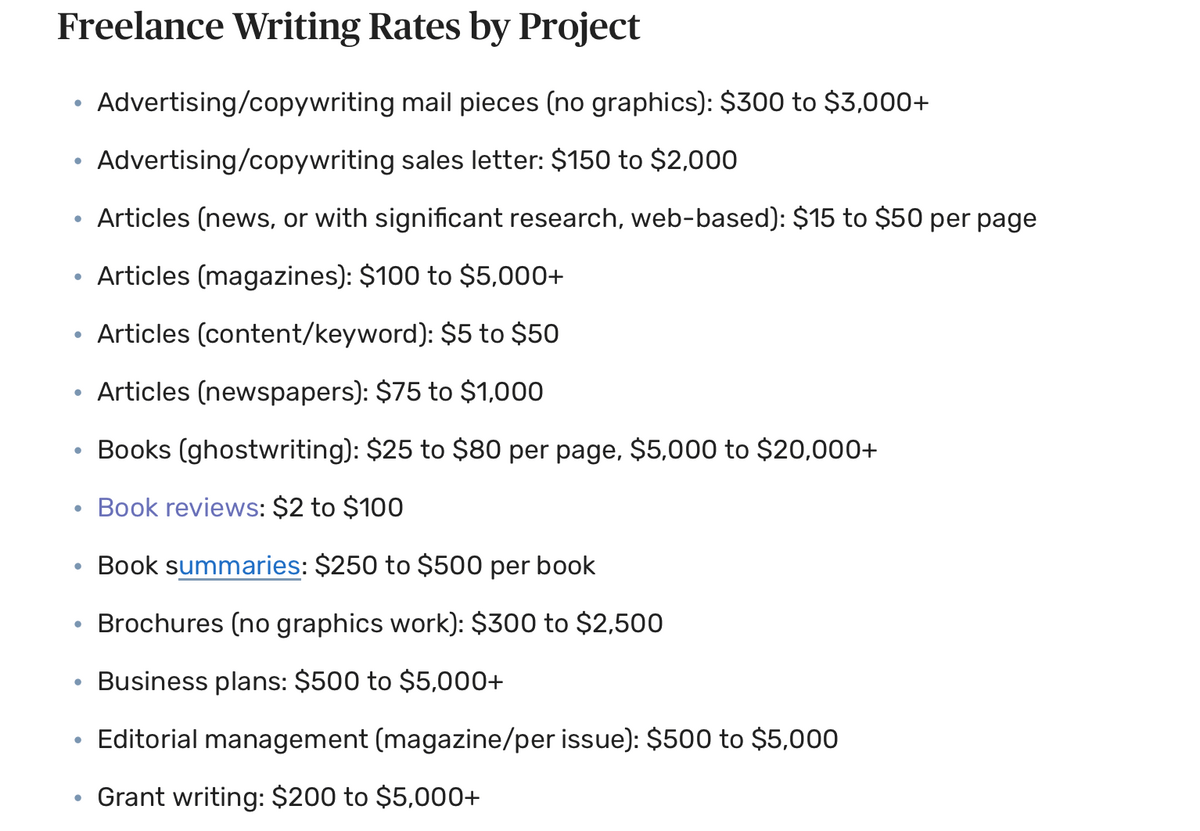

If you aren’t sure about what you should be charging, join industry relevant groups and ask what people are charging with similar deliverables and experience. And if at all possible, you can turn it around and ask the client what their budget is per post or per project; that can give you some valuable information to start with.

You can also Google to see estimated rate sheets based on your industry, though you should always know that there are outliers to these sheets and they’re only meant to be a starting point. The Balance has one here, which you can see a preview of in this image:

And pro tip: In my experience (and in the experience of many others I’ve spoken to), the higher paying clients are typically the easiest to work with because they know what they want and aren’t into micromanaging you.

In theory, anyone who is up for the same jobs as you is your competition. And there are definitely some cut-throat people in the industry who will try to pitch clients they know you’ve landed. Especially freelancers who are looking to land their first remote job, or entrepreneurs who’ve recently started an agency.

They’re few and far between, however, and getting to know other freelancers has been one of the best things I have done for my career in those seven years.

You can get advice about how to handle freelance-specific situations from someone whose business model or judgement you trust. I was once assigned an article that was then edited by the client to have incorrect information, and the editor tried to blame it on me to cover her own job while I had no other contacts at the company and tried to not pay me; that’s not something anyone with a standard full-time job could help with.

There are many freelance communities where people openly share information about their rates and their income, which can help you gauge where you should be. They’ll share tips, and refer people they trust to other clients.

There are plenty of great resources I’m sure I haven’t even discovered yet. My favorite closed-but-public free group is the Copywriters Club (and paid members can join the related and highly valuable Copywriters Underground group and course).

You can also find great resources online that aren’t related to groups where you can learn about information relevant for freelancers. Some of my favorites include:

Freelancing is a little like an adventure. You may not always know which contracts or clients will come around again or exactly where the next project will take you, but the good news is that there’s an abundance of work. If you’re building momentum and doing great work as it is, there will always be more work that follows.

I didn’t know any of this when I started my freelance writing as a side gig in 2012, or even when I really went all-in on my first year freelancing full-time in 2014. The growing pains weren’t always fun, but I also would never go back and choose anything else knowing where it’s brought me today.

And keep in mind that there’s plenty of room for excellent freelance writers out there; many of the top-performing freelancers in any industry are booked many months out and refer potential clients elsewhere. If you’re willing to work hard, there’s so much room to do well.

Want to learn more about tools and resources you can use to improve your freelance writing skills? Check out our blog for more help about content marketing.